Track mileage automatically

Get started.svg)

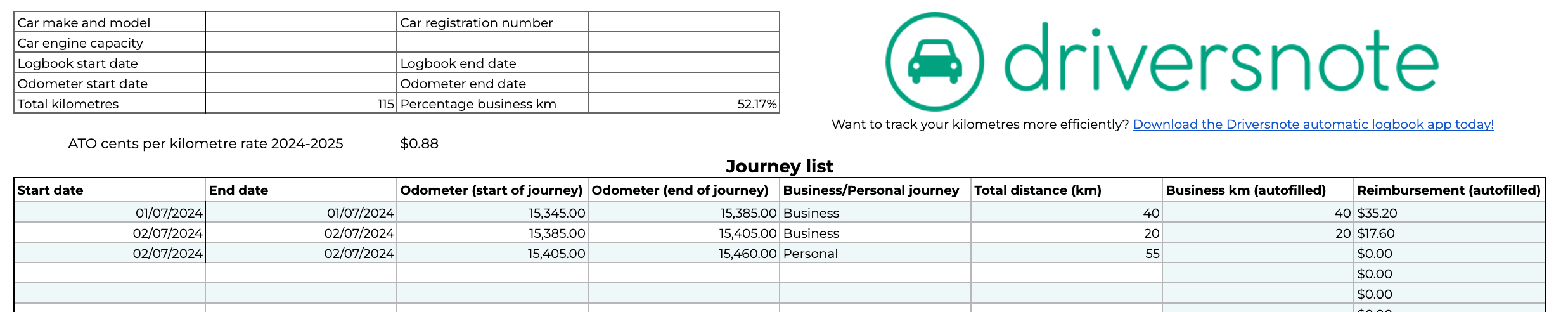

ATO Vehicle Log Book Template

If you claim vehicle expenses for business purposes or receive reimbursement from your employer, you must keep proper records for your claim to be approved. These records are often in the form of a vehicle log book, also known as a car log book.

Download the free log book template as an Excel, Google Sheets, or PDF

Use the buttons above to select the version of the template you want, and follow the onscreen instructions to make a copy of the log book template.

The Excel and Sheets versions include a vehicle log example in another tab so you can see how to fill out your vehicle log book and an empty sheet you can use for your own log.

If you drive a lot for work, manually adding trips may be time-consuming. Consider trying an automatic business km tracker app to save time and ensure all your business kilometres are logged. One such app is Driversnote.

Kilometre tracking made easy

Trusted by millions of drivers

Automate your logbook Automate your logbook

Automatic mileage tracking and ATO-compliant reporting.

Get started for free Get started for freeWhat to record in your log book template

For the logbook method

The ATO outlines clear rules for what information you must fill out in the log book template.

You must log the following details in your log book:

- the period the log book covers

- the vehicle's odometer readings at the start and end of the log book period

- the total number of kilometres you've driven

- the percentage of business-related kilometres you've travelled

- the car make, model, engine size and registration number

For each trip, note down the following information:

- start and end times

- odometer readings

- distance travelled in total

- the reason for the trip

With the logbook method, you deduct your car expenses based on the percentage of business driving throughout the year. These expenses include fuel, maintenance, repairs, registration, interest on a motor vehicle loan, lease payments, insurance cover premiums, and depreciation.

For example, if the business use percentage of your vehicle is 50%, you can deduct 50% of all eligible car expenses you had throughout the year. Keep all receipts related to those expenses, as these will be used to support your claims to the ATO.

Read more about the ATO logbook method and how to claim business km with it.

The cents per km method

If you claim business km deductions using the cents per km method, the ATO doesn't require you to keep a vehicle log book. However, the tax authority may ask you to show how you've worked out the business kilometres you claim. With this in mind, we recommend that you keep a car log book and keep track of all your business trips, the reason for them, and the date and distance.

See how to claim business kilometres using the ATO cents per km method.

How to use the ATO vehicle log book template

Recording your trips in the Excel or Sheet templates will calculate your reimbursement according to the official ATO cents per km rate. For 2024/2025, the cents per km rate is $0.88.

If you want to use the logbook method for your business km claim, remove the Reimbursement column.

Note that if you print out any of the templates, you will have to calculate your reimbursement independently.

For example:

You drive your vehicle for business and receive reimbursement at the ATO cents per km rate.

You have driven 1300 kilometres for work, and you receive a reimbursement of $0.88 per km. To determine how much you will be reimbursed, multiply the number of kilometres by the rate:

1300 (km) x 0.88 $ (rate) = 1144 $ (your reimbursement)

Alternatively you can also use our ATO cents per kilometre calculator.

FAQ

Tired of logging mileage by hand?

Effortless. ATO-compliant. Liberating.

Top posts

- Driversnote vs GOFAR

- Work-Related Travel Expenses for Employees

- Sole Trader Tax Deductions: An Essential Guide

Related posts

ATO Mileage Guide

Latest update: 23 June 2025 - 5 min read

Learn about the rules of reimbursing employees for their car expenses or deducting expenses as an employee or self-employed individual.

Driversnote vs GOFAR

Latest update: 2 February 2026 - 10 min read

Compare Driversnote and GOFAR in 2026. See which logbook app is best for ATO compliance, ease of use, privacy, and everyday driving needs.

Work-Related Travel Expenses for Employees

Latest update: 16 January 2026 - 2 min read

Learn about the ATO rules on work-related travel expenses and see if they are reimbursable or deductible at tax time in Australia.