How to automate your mileage logbook

Keeping a logbook has never been easier. Track your kilometres automatically with an electronic logbook and quickly create and share your logbook for your reimbursement or deductions.

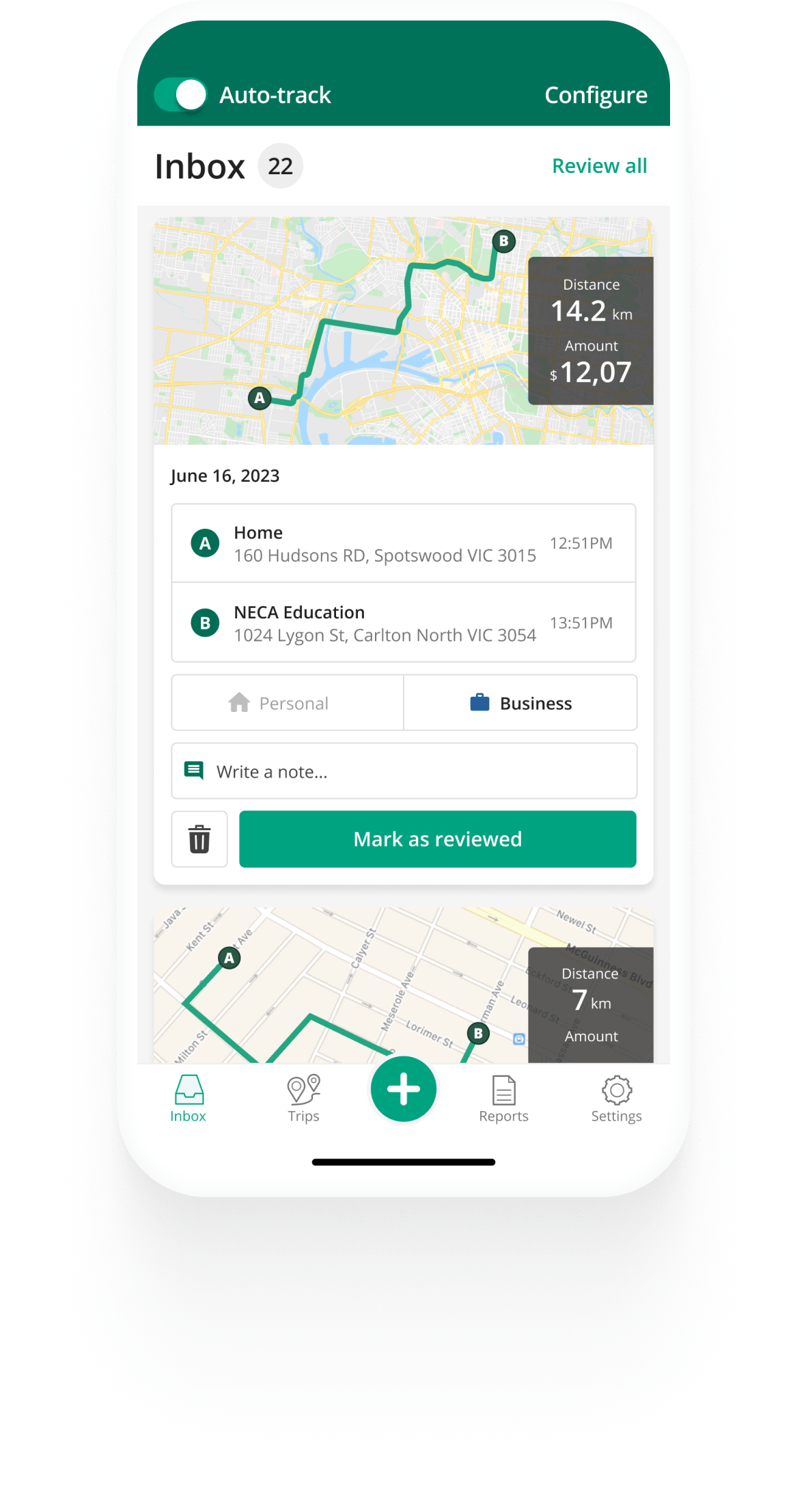

How to automatically track kilometres

Mileage tracking made easy

Use the Driversnote car logbook app to track trips automatically - no need to even open the app. We will log all the required information for you and calculate your reimbursement. You can always add or edit trip details later on.

Read more Sign upIntelligent classification of your trips

Business or Personal?

Stay ATO compliant by logging your mileage under the correct category. Review and classify your trips as Business or Personal in a simple overview. Add your working hours to the app and we will even classify your trips automatically.

Read more Sign upWhat our customers say about us

Great App This app is great & so easy to use. Helps so much to keep track of kilometres & distance traveled. Definitely recommend

Absolutely brilliant app. Never had any issues with the Tax department since using DriversNote. Very helpful support staff and an all around great company to deal with.

Seems to be doing a great job of producing a human readable (and spreadsheet exportable) log of my driving, with minimal effort. Thank you for the well designed tool!

Great app Had to use this for work. Brilliant, easy to use, great reporting for month/year end. Highly recommend it.

Great app, good value and great service This app does what it says. It is useful and cost effective and easy to use. Even better their support team is super responsive. I asked a few questions and got a super speedy professional and friendly response. Highly recommended.

Great app to log work trips and record for tax purposes or reimbursable vehicle expenses

Great app Had to use this for work. Brilliant, easy to use, great reporting for month/year end. Highly recommend it.

Great app, good value and great service This app does what it says. It is useful and cost effective and easy to use. Even better their support team is super responsive. I asked a few questions and got a super speedy professional and friendly response. Highly recommended.

Great app to log work trips and record for tax purposes or reimbursable vehicle expenses

I drive over 100 miles a day for work, and I could not do this job as well without this mileage tracker. It's simple, easy to use, and takes care of all my mileage documentation for taxes.

Driversnote is a brilliant journey tracking system. No more need to keep writing down mileage, etc. This system automatically logs all journeys for you. I would highly recommend it to others.

looking good so far. Auto tracking seems to work well, will turn on pro features in a week

I drive over 100 miles a day for work, and I could not do this job as well without this mileage tracker. It's simple, easy to use, and takes care of all my mileage documentation for taxes.

Driversnote is a brilliant journey tracking system. No more need to keep writing down mileage, etc. This system automatically logs all journeys for you. I would highly recommend it to others.

looking good so far. Auto tracking seems to work well, will turn on pro features in a week

Frequently Asked Questions

Your ATO logbook needs to contain specific information for each trip. Record the kilometres driven, time, destination and purpose for each. Remember to also log your vehicle’s odometer at the start and end of the year. While you can keep a paper logbook, you can save a lot of hassle by using a car logbook app that will automate this process for you.

Calculate your business kilometres reimbursement by multiplying the kilometres driven by the cents per kilometre rate you’re reimbursed at. For example, if you’ve driven 4000 business kilometres this year, and use the ATO mileage rate (72 cents for the 2021/2022 tax year) the calculation will be the following:

4000 km x 72 cents = $2880 in mileage reimbursement.

If you drive for business purposes, we strongly encourage you to track your mileage! Using a car logbook app will save you time as you don’t need to log information manually and you’ll have all the information needed for your reimbursement. A car logbook app will keep all your records safely stored, and you don’t need to worry about losing your log.

Get started for free

Never miss a trip

We've got you covered, and it's easy to get started, and even easier to keep going.