Track mileage automatically

Get startedHow To Claim Car Expenses From The ATO In 5 Steps

It’s common for many people to have to use their vehicle as part of their job. That usage can incur expenses such as fuel and general wear and tear on your vehicle. You may be able to claim car expenses tax deductions when using your vehicle to earn income.

Who can claim car expenses?

Anyone who uses their car for business purposes can claim car expenses as a tax deduction, as long as there is evidence that the expense was incurred and that it was for business reasons.

Note that if you receive reimbursement for your business kilometres as an employed individual, you cannot also claim car expenses at tax time.

Kilometre tracking made easy

Trusted by millions of drivers

Automate your logbook Automate your logbook

Automatic mileage tracking and ATO-compliant reporting.

Get started for free Get started for freeMethods for claiming motor vehicle expenses

In Australia, there are three separate methods under which you may claim car expense tax deductions: the logbook method, the actual expenses method and the cents per km method. The logbook and actual expenses methods are very similar, and depending on your sole tradership situation, you will be obliged to use one of the two.

Depending on which gives the greatest result, either the cents per km tax deduction or claiming each separate car expense may be used, however, you cannot use both at the same time.

Feel free to use the infographic on your website. Just remember to credit Driversnote with a link to this article.

With Driversnote you can share your vehicle log book with the ATO or your employer at the touch of a button. Try the automated logbook app for free.

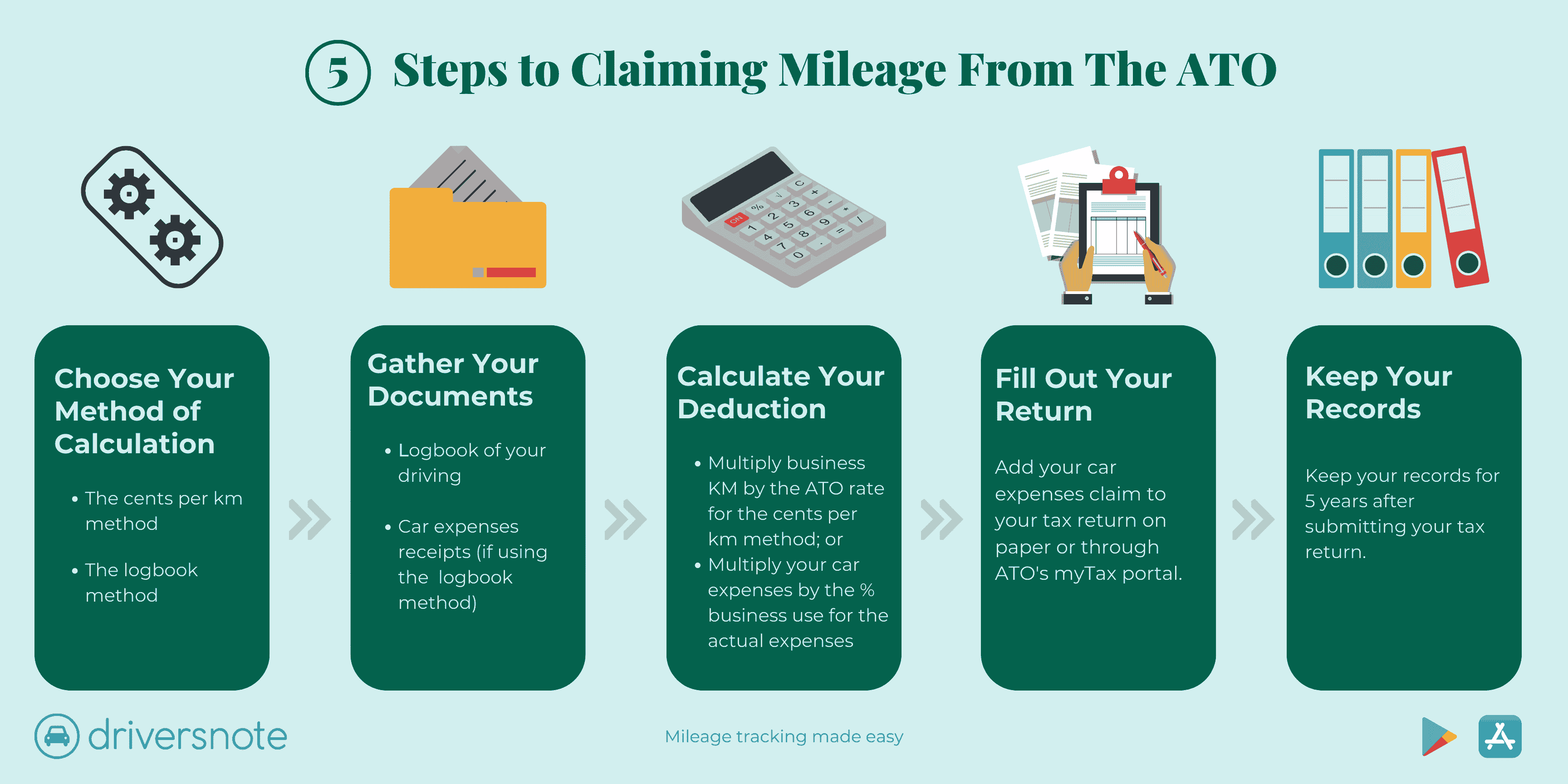

Steps for claiming car expenses from the ATO

Follow these simple steps when claiming car expenses tax deductions.

1. Select your method of claiming car expenses

Determine whether the cents per km or logbook method gives you the best car expenses tax deduction.

For the logbook method, add up all of your receipts for fuel, travel, servicing, registration and insurance, and calculate any depreciation on your vehicle. Use your logbook to then determine the business percentage usage to give you the total car expenses tax deduction.

The cents per km tax deduction is capped at a maximum of 5,000 km per year and is intended to cover all relevant expenses related to using your car for work purposes.

2. Gather your documentation

Have all the relevant documentation available, such as a logbook and receipts for all of your work-related car expenses claims. If you are using the cents per km tax deduction, you do not need receipts, however, you will need an up-to-date log book (12 contiguous weeks in the past five years) and the number of kilometres travelled during the year. If you are claiming depreciation under the logbook method, you will need the purchase receipt, the depreciation schedule and the method used for calculating the depreciation.

3. Calculate your deduction

If you use the cents per kilometre method, simply multiply the year's business kilometres by the ATO cents per km rate to work out your deduction. See the cents per km rate for 2024/2025 if you're claiming business travel for the 2024/2025 tax year.

The ATO has also announced the 2025/2026 rate at 88 cents per km.

If you use the logbook method, figure out the percentage of business driving from your total kilometres for the year. If you drove 40% for business-related purposes, you will be able to claim 40% of the year's incurred car expenses.

Once you have calculated the amounts, determine which of the logbook method or cents per km method gives you the highest figure for your car expenses claim. You must choose just one method, as you cannot use both at the same time.

4. Fill out your tax deduction claim

To claim your car expenses tax deduction, on your tax return, you can then enter the method used, along with either the number of kilometres or the total car expenses claimed and the percentage of business usage. You may lodge your tax return on paper, via the ATO’s myTax portal or through a registered tax agent.

5. Keep your records

After lodging your tax return, keep all receipts and other proof for 5 years in case the ATO audits your returns. Consider using an online solution for tracking your business kilometres that will keep your logs safe, such as Driversnote.

Benefits of tracking and claiming car expenses

The primary benefit of tracking and claiming car expenses is to reduce your taxable income and therefore the amount of tax that you need to pay. Additionally, the costs incurred from using your vehicle for work purposes are offset by the car expenses tax deduction.

FAQ

Tired of logging mileage by hand?

Effortless. ATO-compliant. Liberating.

ATO Mileage Guide

- For Self-Employed

- For Employees

- For Employers

- The Cents per Kilometre Method

- The Logbook Method

- ATO Log Book Requirements

- Claim Car Expenses In 5 Simple Steps

- Calculate Your Car Expenses Reimbursement

- ATO Car Expenses Deductions

- Car Fringe Benefits Tax

- Is Mileage Reimbursement Taxed?

- Historic Cents Per KM Rates

- ATO Cents Per KM Rate 2021/2022

- ATO Cents Per KM Rate 2020/2021