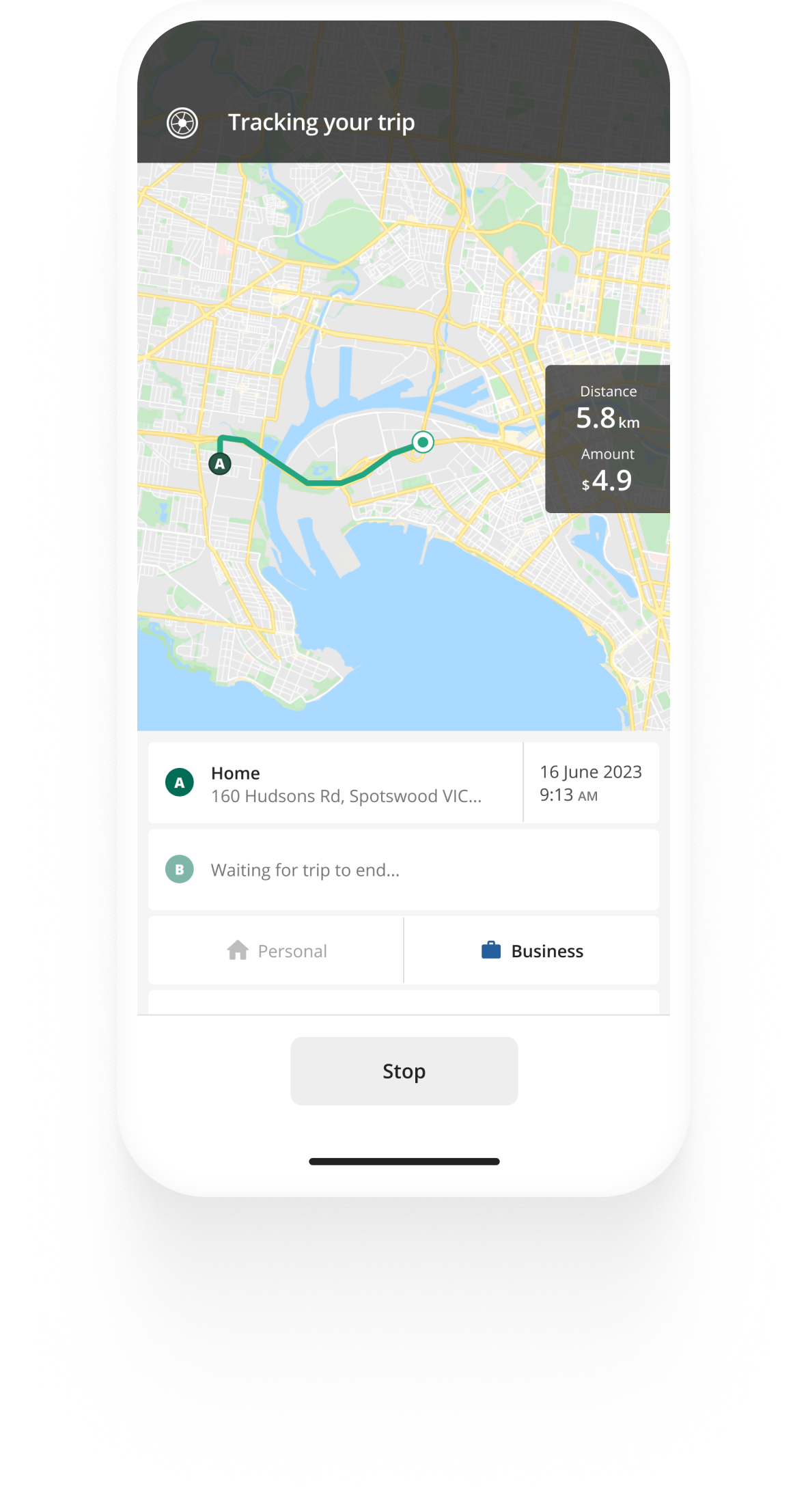

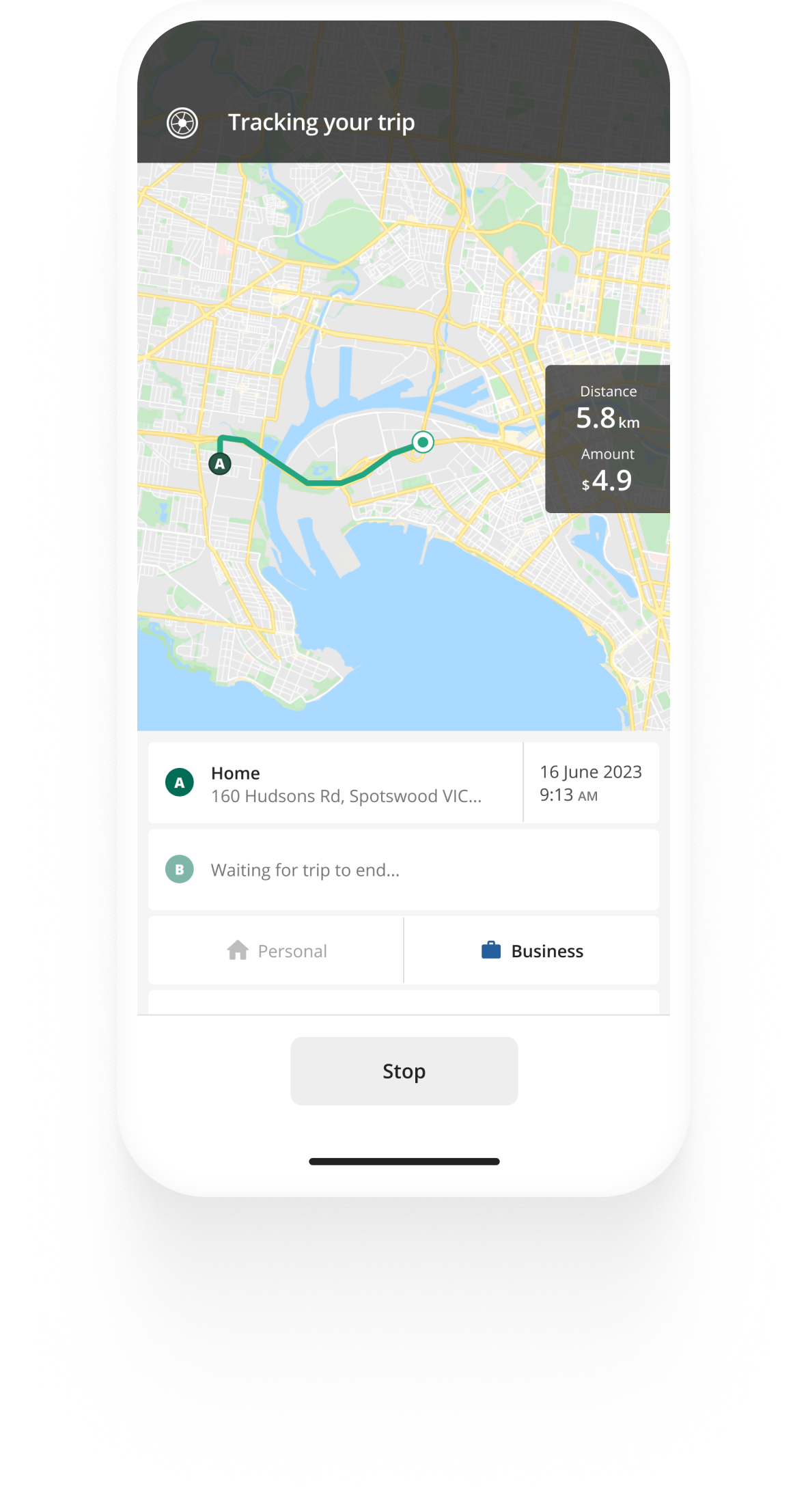

Track mileage automatically

Get startedWhat is an Audit?

In this article

An audit is an official examination of your individual or your business tax conducted by the ATO. Audits are typically conducted after a review but can be started directly too if the ATO deems it necessary.

ATO audit process

The ATO will call to inform you that you are being audited and arrange a meeting time. You will also receive an official letter of confirmation. During the meeting, the tax office will inform you of the process by outlining the reasons why you’re being audited, what periods they’ll look at, your responsibilities during the process and more.

The tax office will request records you keep for tax purposes that they examine during the ATO audit. The requested records will differ on a case to case basis. If you readily cooperate by providing all the requested records, the ATO audit will go faster and will reach a conclusion at the soonest.

If you choose not to assist the ATO and provide the information they require, the tax office can use their formal powers to access this information.

During the ATO audit, you will be frequently updated on the process’ status.

Kilometre tracking made easy

Trusted by millions of drivers

Automate your logbook Automate your logbook

After the audit

When the ATO audit is concluding, expect to receive an official paper with the findings. You are able to respond to the findings and then the audit will be concluded with the tax office’s final decision on the matters.

In some cases, you may be able to apply for an alternative dispute resolution (ADR) - the ATO will inform you if this is a possibility for your case.

If the ATO audit finds that you have tax to pay back, the office will normally contact you and inform you if they need to edit your tax assessment. You will be able to then apply for a reduction or remission of the interest and penalty charges.

How far back can the ATO audit?

The ATO looks at the past two years for simple income tax assessments from when the assessment is issued. For more complex tax assessments, the ATO looks at the past 4 years from the date the assessment is issued.

Are you claiming deductions for your car expenses? See the records you'll need to keep in order to comply with the ATO's rules in our guide on car log book requirements for tax.

FAQ

Automate your logbook

Related posts

Per Diem Allowance

Find out how much you can get per day for food, accommodation and other incidentals while away on business. See what you need in order to receive non-taxable per diems.

ATO Mileage Guide

Learn about the rules of reimbursing employees for their car expenses or deducting expenses as an employee or self-employed individual.

ATO Compliant Log Book Template

If you are claiming vehicle expenses for business purposes, you must keep proper records in order for the ATO to approve your claim. We will walk you through...

.svg)