Trusted by millions of users

Auto-track

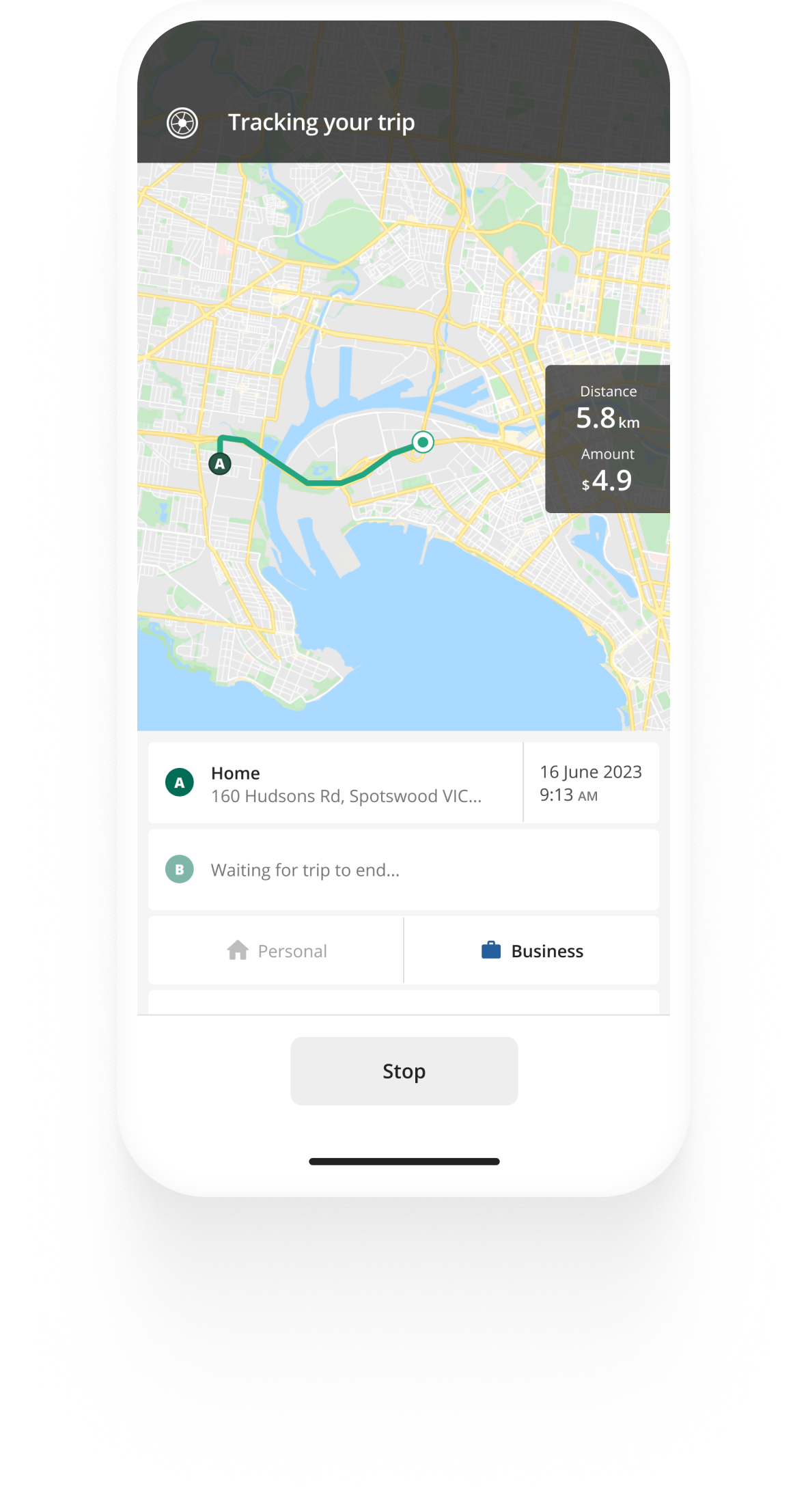

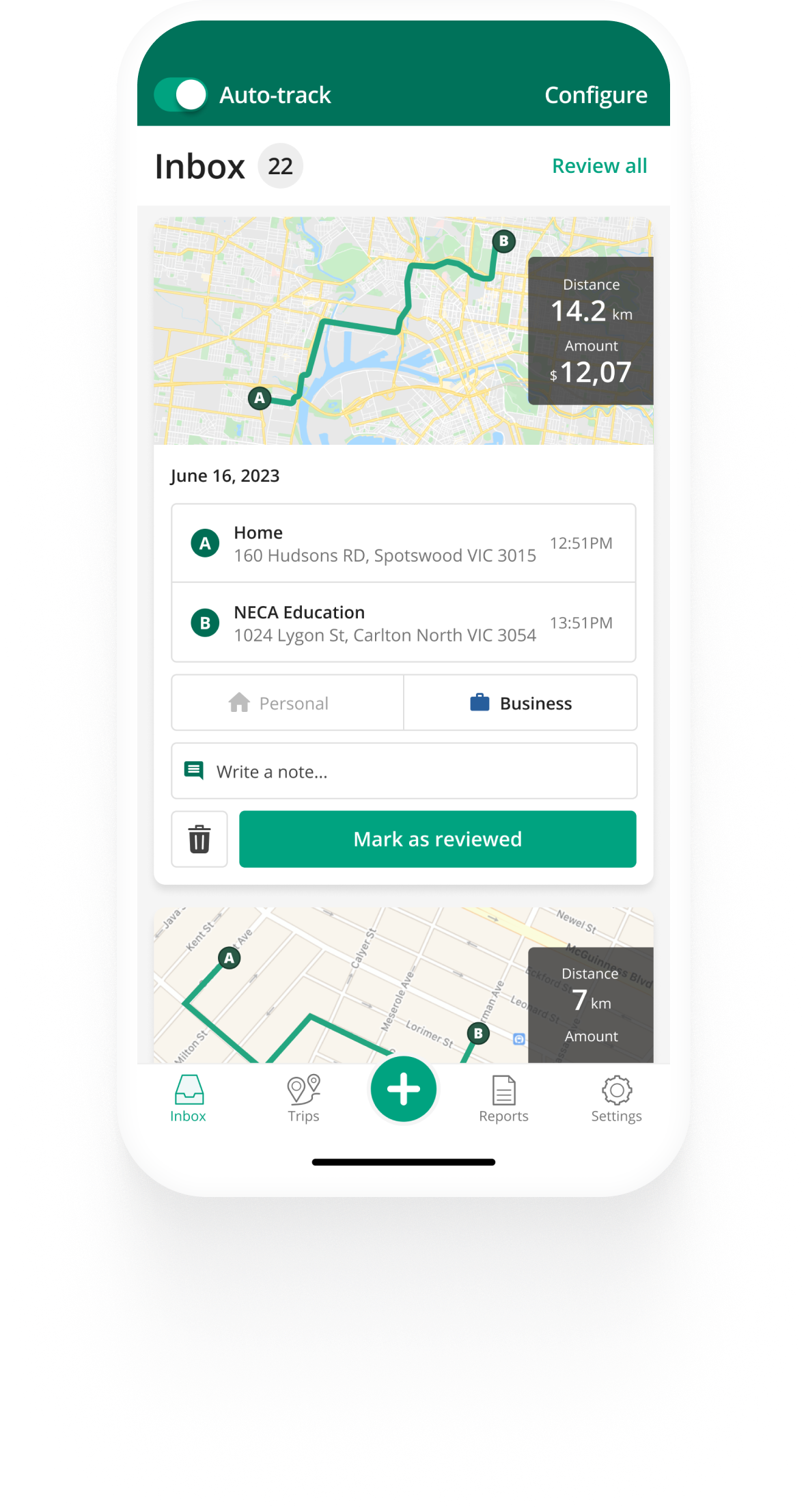

Track trips from your pocket

With Driversnote as your automatic mileage tracker, you can record trips without even opening the app. The motion detector lets you auto-track trips - all you have to do is drive. And if you forget to track, you can easily create manual trips later.

Read more Sign upWhat our customers say about us

looking good so far. Auto tracking seems to work well, will turn on pro features in a week

easy to use

Good app. Customer service is really good. 10/10

Excellent Product is fantastic, customer service is even better.

No issues!

Works very well. Simple and easy, does what it says it will do. I have not had any problems.

Excellent Product is fantastic, customer service is even better.

No issues!

Works very well. Simple and easy, does what it says it will do. I have not had any problems.

free and it works

Steve from customer service politely asked me to leave a review, so here I am. This is a good app. Does exactly what it needs to do. If your job involves driving, use this app to record your work related trips, and you can use it on your tax return to get some money back on fuel usage.

good app

free and it works

Steve from customer service politely asked me to leave a review, so here I am. This is a good app. Does exactly what it needs to do. If your job involves driving, use this app to record your work related trips, and you can use it on your tax return to get some money back on fuel usage.

good app

The features that make mileage tracking less of a pain

Create locations

Track your trips faster by saving frequently visited places.

Multiple vehicles

Track mileage and keep separate logs for multiple vehicles.

Multiple Workplaces

Track mileage and keep separate logs for multiple workplaces.

Work Hours

Set your work hours and let the app categorise your trips automatically.

Reporting Reminders

Submit your mileage reports on time, every time. We'll simply notify you when it's time.

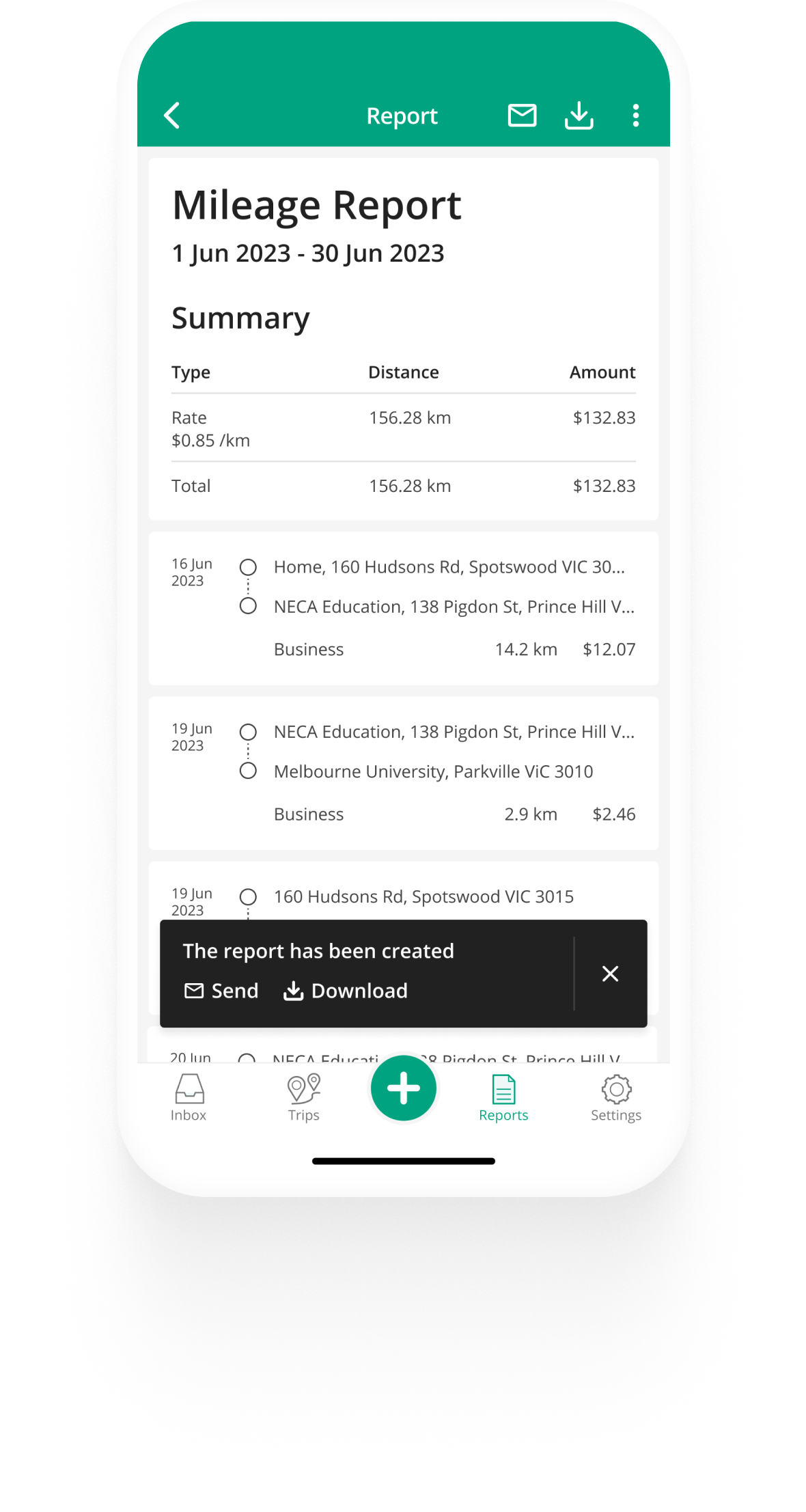

Custom Mileage Rates

Customise your log book with the mileage rates you are reimbursed at.

Odometer Log

Add odometer readings, and get reminders for a complete logbook.

Track Trips Manually

Log manual trips and we'll calculate the distance for you.

Team Management

Review and approve mileage claims for your organisation with ease. Contact us to learn more.

Work Hours

Set your work hours and let the app categorise your trips automatically.

Reporting Reminders

Submit your mileage reports on time, every time. We'll simply notify you when it's time.

Custom Mileage Rates

Customise your log book with the mileage rates you are reimbursed at.

Odometer Log

Add odometer readings, and get reminders for a complete logbook.

Track Trips Manually

Log manual trips and we'll calculate the distance for you.

Team Management

Review and approve mileage claims for your organisation with ease. Contact us to learn more.

Latest posts

ATO Cents per KM Rate 2023-24

The 2023/24 ATO cents per km rate has been officially announced. See how to claim business kms and how to use the 2023/24 rate.

ATO Cents per km Rate 2024-25

The ATO cents per km rate for 2024-25 will soon be confirmed. See the changes we expect and how you will be able to use the new rate.

ATO Cents Per KM Calculator

The cents per km calculator is based on the 2023/2024 cents per km rate and allows you to estimate your deduction/reimbursement

Frequently Asked Questions

If you travel for work you should keep a detailed car log for tax in order to receive full KM reimbursement. If you drive often, an automatic car log book app like Driversnote will save you time.

The Driversnote log book app works great for both self-employed and employees. You are able to keep timely records of both personal and business driving with automatic tracking and submit compliant mileage records.

Yes! Driversnote offers a Team solution for companies. Employees can track their trips and submit their ATO compliant car logs on time. The team manager or accountant receives consistent mileage reports all in one place. See more about our Team solution.

.svg)